Founded in 2022, Shah Equity is a private equity firm dedicated to reshaping traditional industries through bold strategies and data-driven innovation.

While Shah Quantum Fund underpins our liquidity and hedging tactics, Shah Equity's primary focus is on identifying and transforming high-potential opportunities across three core verticals—Real Estate, Health Care, and Home Services. By combining strong cash flow assets with strategic, value-add real estate plays, we mitigate market fluctuations and deliver substantial, hedged returns.

A Fusion of Data and Intuition

We believe that genuine value emerges when cutting-edge analytics intersect with practical market insight. Every acquisition begins with rigorous data analysis, balanced by our global team’s deep operational instincts. Through advanced AI modeling, we evaluate myriad scenarios—anticipating both risks and upsides—before committing capital. This approach preserves our edge while minimizing uncertainty for our partners.

Technology-Fueled Efficiency

From offshore talent to AI-driven automation, our mission is to optimize each portfolio company’s performance. Leveraging these efficiencies allows us to reinvest resources into strategic growth and pass substantial savings on to investors. We view technology as a catalyst for transformative change, not a mere cost-saving tool.

Transformative Growth Over Transactions

At Shah Equity, we don’t just buy businesses—we refine them for the long haul. Whether by modernizing operations, upgrading customer experiences, or introducing new service lines, our hands-on approach paves the way for sustainable expansion and resilient partnerships.

A Group of The Sharpest Minds Across the Globe

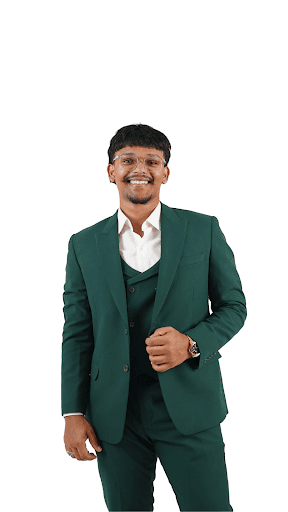

Founder & Principal, Noorullah Shah Hussaini

Noorullah Hussaini envisioned a firm that transcends borders and conventional finance models, harnessing Shah Quantum Fund to ensure steady liquidity while building a diverse private equity portfolio under Shah Equity. Today, we operate from 8 offices worldwide, employing 300+ team members who bridge the U.S., Asian, and Gulf markets with a unified vision of high-performance, ethical investing.